Property Tax Savings Opportunities

__________________

Tax savings opportunities can vary widely depending on your individual circumstances. Consulting with a tax professional or financial advisor can help you identify the best tax-saving opportunities for your specific circumstances. Please read through the numerous programs listed below to learn how you can save on your property taxes.

Exemptions

Exemption on a residence that is both owned and occupied as the principal place of residence.

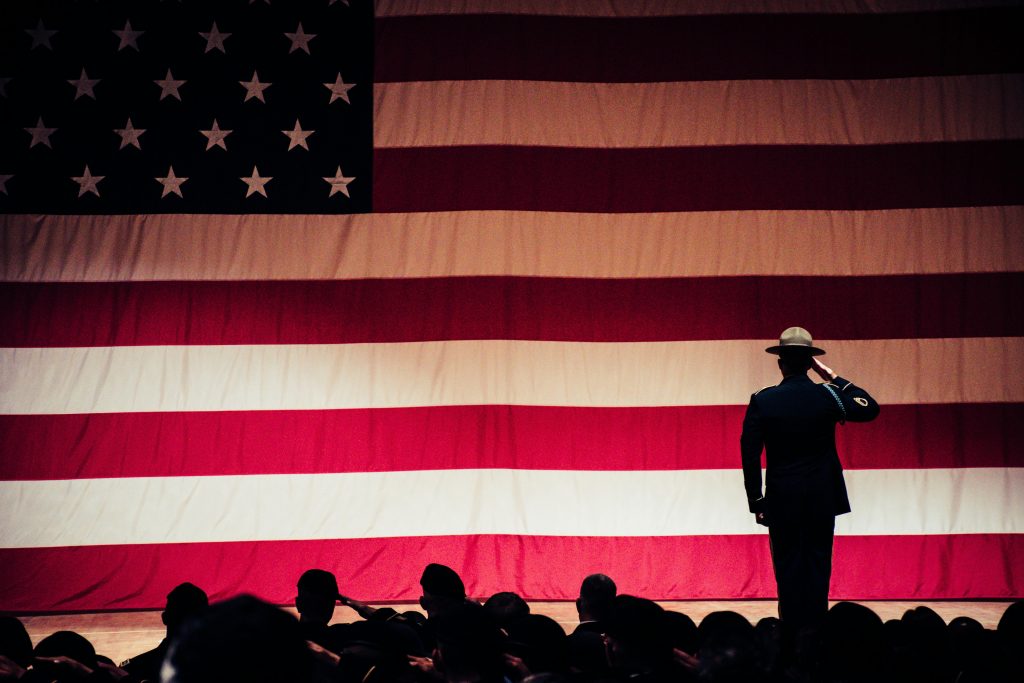

A veteran who owns & occupies a home as their principle place of residence and who is rated 100% disabled by the V.A. due to a service connected disability.

Real and personal property used exclusively by a church, non-profit college, cemetery, museum, school or library may qualify for an exemption.

Allows the Assessor to temporarily lower assessments when the market value on January 1 is lower than the factored base year value for that year.

Exclusions

Senior citizens 55 years of age can buy a residence and transfer their current assessed value to the new home if the new residence is of equal or lesser market

The transfer of the principal place of residence and/or the first $1,000,000 of other real property may be excluded from reassessment.

The transfer of property between husband and wife does not result in a reappraisal for property tax purposes.

Property owners that have property taken by government action or eminent domain proceedings may qualify for an exclusion from reappraisal.

Completed new construction may be excluded from supplemental assessment under certain circumstances.

If a major calamity such as a fire or flood damages your property, you may be eligible for property tax relief.

Other Property Tax Savings Resources

This program allows homeowners who are seniors, are blind, or have a disability to defer current-year property taxes on their principal residence.

The California State Board of Equalization Taxpayer Advocate Office has further details regarding tax savings opportunities.