Change of Ownership

When a change in ownership occurs, the Assessor receives a copy of the recorded deed or other official document and determines if an appraisal is required under State law. If it is required, an appraisal is made to determine what the new assessed value of property will be. The property owner is then notified of the new assessment and has the right to appeal the value.

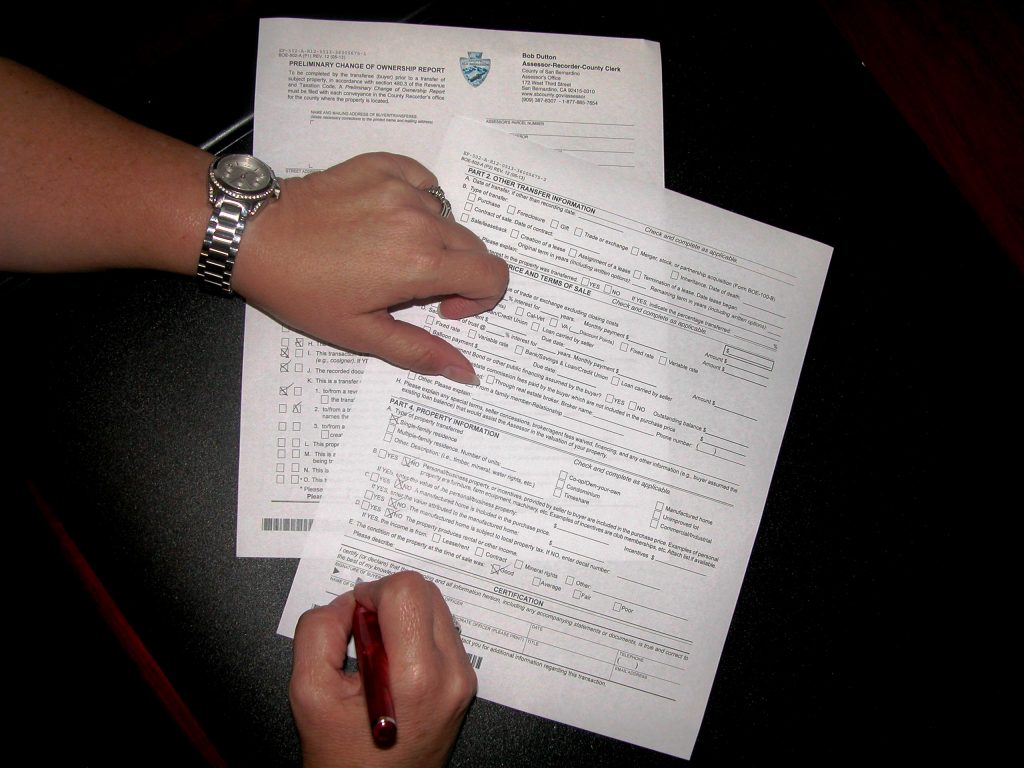

Preliminary Change of Ownership

State law requires the buyer of real property to file a Preliminary Change of Ownership Report with the County Recorder’s Office at the time a document is recorded which transfers ownership of the property. If this form is not filed, the recorder will charge an additional fee of $20. Information furnished on this form by the property owner assists the Assessor in determining the proper value. It is not a public document.

Change in Ownership Statement

The Assessor will use this form when the Preliminary Change of Ownership Report is either not filed or is filed incomplete. State law provides for a penalty to be levied if the Change in Ownership Statement is not returned to the Assessor within a timely filing period. The penalty for failure to file a Change in Ownership Statement is $100 or 10% of the new tax bill, whichever is greater, but not to exceed $20,000.

For further information contact the Exclusions Department at (909) 387-8307, Opt. 6 or toll free at (877) 885-7654.

Legal Advice Limitation

The Assessor’s Office is prohibited from giving legal advice. It may be advisable to consult an attorney because of the legal aspects involved in holding title to property or transferring title.